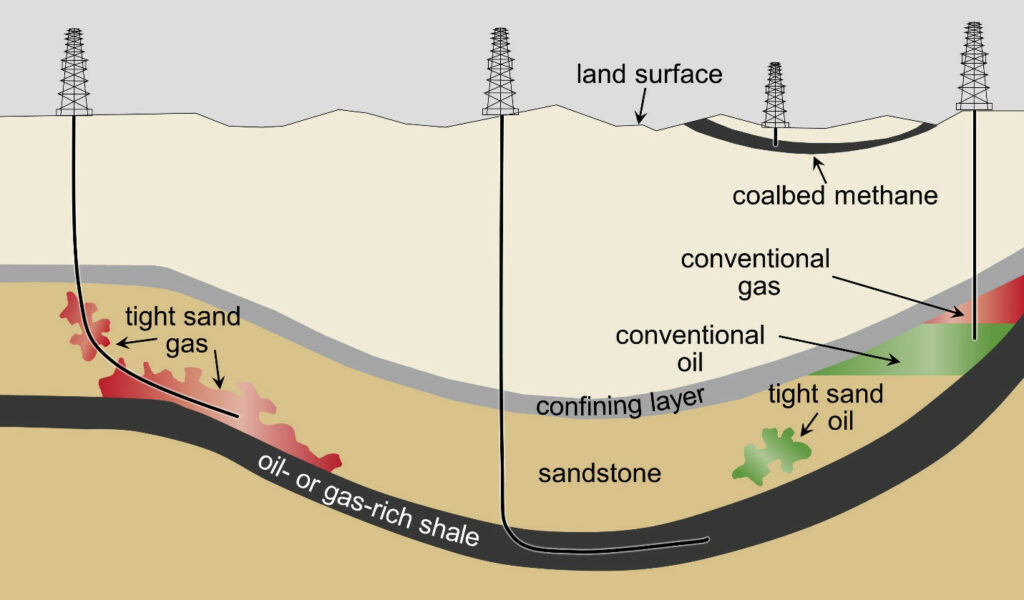

The reality of the marketplace, however, is often not so clear sometimes it can be downright murky. The DCF’s use of present value mathematics deters investment at low ends of pricing cycles. While DCF techniques are generally reliable for proven developed reserves (PDPs), they do not always capture the uncertainties and opportunities associated with the proven undeveloped reserves (PUDs) and particularly are not representative of the less certain upside of possible and probable (P2 & P3) categories.

The DCF can break down in light of marketplace realities and “gaps” in perceived values can appear. When market, operational, or geological uncertainties become challenging, such as in today’s low price environment, the DCF can break down in light of marketplace realities and “gaps” in perceived values can appear. These techniques are generally accepted and understood in oil and gas circles to provide reasonable and meaningful appraisals of hydrocarbon reserves. The petroleum industry was one of the first major industries to widely adopt the discounted cash flow (DCF) method to value assets and projects-particularly oil and gas reserves. The Struggle: Valuation in D i s tressed Markets

#REAL OPTIONS VALUATION IN OIL AND GAS HOW TO#

Whether companies are looking to sell these reserves to improve their cash balance, or are trying to generate reorganization cash flow projections during a Chapter 11 restructuring, understanding how to value PUDs and unproven reserves is crucial to survival in a down market. In this post, we re-examine how option pricing, a sophisticated valuation technique, can be used to understand the future potential of the assets most affected by low prices, PUDs and unproven reserves. have struggled to pay their debts, and in many cases already have had to file for bankruptcy.

Due to the precipitous drop in oil prices in 2020, oil E&P companies in the U.S.

0 kommentar(er)

0 kommentar(er)